Southern Silver Exploration Corp. is an exploration and development company with a focus on the discovery of world-class mineral deposits either directly or through joint-venture relationships in mineral properties in major jurisdictions. Our specific emphasis is the 100% owned Cerro Las Minitas silver-lead-zinc project located in the heart of Mexico's Faja de Plata, which hosts multiple world-class mineral deposits such as Penasquito, Los Gatos, San Martin, Naica and Pitarrilla. We have assembled a team of highly experienced technical, operational and transactional professionals to support our exploration efforts in developing the Cerro Las Minitas project into a premier, high-grade, silver-lead-zinc mine. Located in the same State as the Cerro Las Minitas property is the newly acquired Nazas property. Our property portfolio also includes the Oro porphyry copper-gold project and the Hermanas gold-silver vein project where permitting applications for the conduct of a drill program is underway, both located in southern New Mexico, USA.

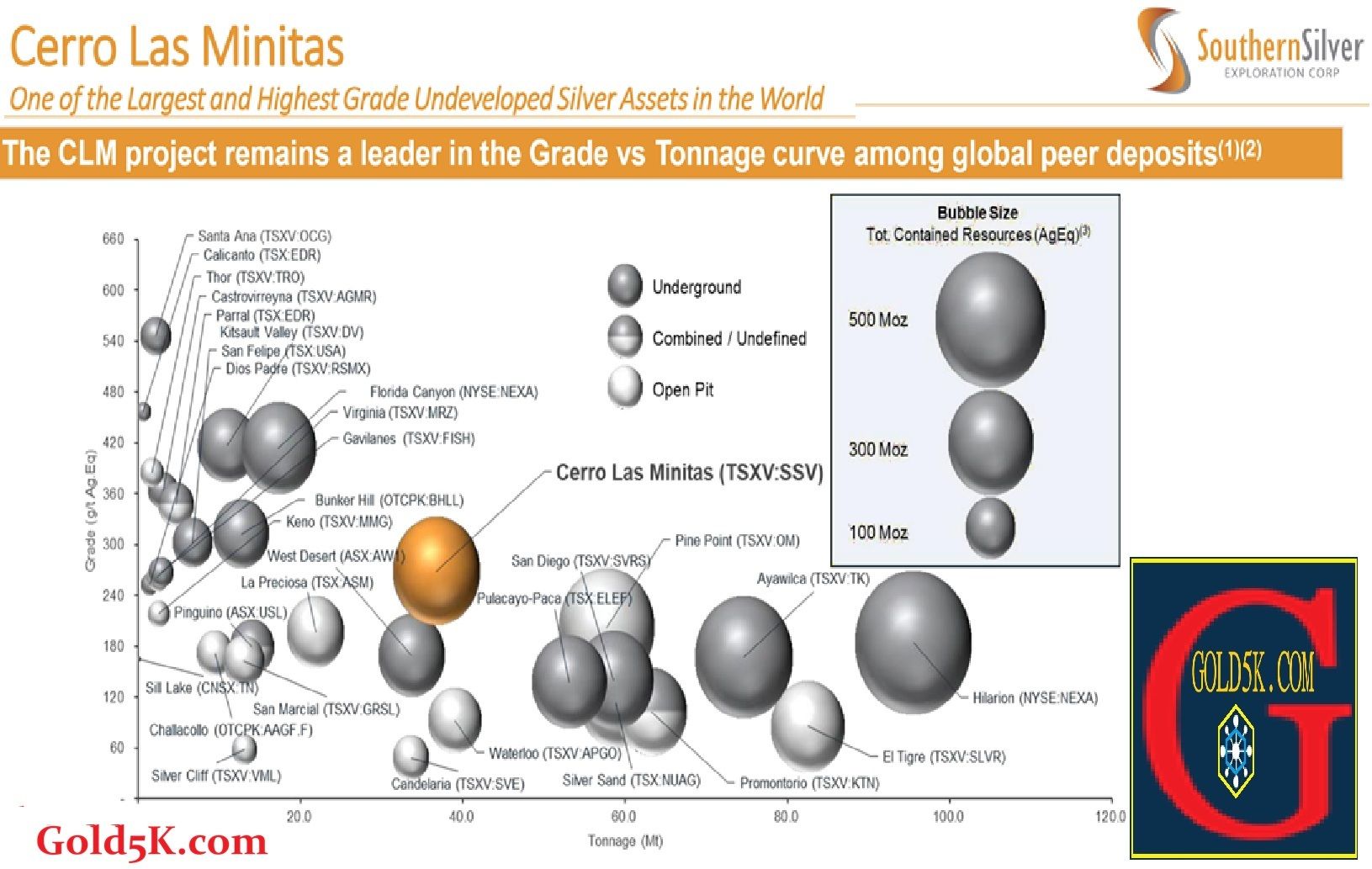

Southern Silver’s growth strategy is to focus on the development of quality assets, in significant mineralized trends, close to infrastructure. Recent work on the company’s flagship Cerro Las Minitas project outlined a preliminary economic assessment with an after tax NPV5% of US$501M and IRR of 21.2%. For additional details, see news release dated June 10th, 2024 and report dated July 23rd, 2024 here. Southern silver also recently acquired an option to own 100% of the exciting greenfields Nazas project, 12km from Endeavour Silver’s Pitarilla project where exploration since the 1990s has discovered several drill ready high-grade Au-Ag-Polymetallic Targets. Combined with a low market capitalization, and low operating costs, this provides an excellent opportunity for future corporate growth and an increase in shareholder value.

Latest Drilling Results

Key Highlights

Southern Silver continues to advance their flagship Cerro Las Minitas silver-lead-zinc property located in Durango State, Mexico. At over 270 square kilometers in size, the project features a large land position within the prolific Faja de Plata (Belt of Silver) of northern Mexico, with historic production and resources of over three billion ounces of silver and additional potential for future “world class” discoveries.

On June 10th, 2024, the company released an updated Preliminary Resource Assessment on the Cerro Las Minitas Project. Summary details are as follows (all figures in US$ unless noted):

Robust Project Economics - Base Case: after-tax NPV5% of $501M (C$682M) and IRR of 21.2% (using Au - $1850/oz, Ag- $23.00/oz, Cu – $4.00/lb, Pb – $1.00/lb and Zn - $1.25/lb);

Excellent Silver and Zinc Price Leverage - Base-case +20%: after-taxNPV5%of $875M (C$1,193M) andIRRof30.2%(using Au - $2,220/oz, Ag- $27.60/oz, Cu – $4.80/lb, Pb – $1.20/lb and Zn - $1.50/lb);

Large-Scale Underground Mining Operationwith a 17-year mine life with an annual average plant feed of 14.3 Mozs AgEq (inc. 5.8 Mozs Ag) at an AISC of $13.23/oz AgEq sold ;

High-Revenue Project:Base Case gross revenues total US$4.5B with silver and gold representing 45% of revenues, zinc representing 35% of revenues. The project has an Initial CapEx of $388M and an NPV-to-CapEx ratio of 1.3X;

Well Located Project in a mining friendly jurisdiction with excellent infrastructure in southeast Durango state, Mexico; and

Further Exploration Upside: Deposits remain open laterally and to depth and remain to be explored

The study was based on a resource estimate, effective March 20th, 2024 of 43.4Moz Ag, 374Mlbs Pb and 921Mlbs Zn (116Moz AgEq) Indicated and 83.3Moz Ag, 582Mlbs Pb and and 1.1Blbs Zn (186Moz AgEq) Inferred(1)

Disclaimer/Disclosure

Sponsored content developed and distributed on behalf of the company, we've received/expecting to receive a payment of US$ 30,000 to conceive, create and distribute marketing material and adverts.